Access to healthcare and support is one of the biggest priorities for many Australian veterans and their families after leaving the Defence Force. The DVA Gold Card helps make that possible, giving eligible veterans, their dependents and some civilians access to a wide range of fully funded medical services.

In this guide, we’ll break down what the DVA Gold Card is, what it covers, who can get it and how to use it. Whether you’re a veteran looking for support or a family member trying to understand your options, knowing how the card works can help you get the care you’re entitled to.

From everyday medical needs to mental health services and transport to appointments, the DVA Gold Card helps ease the pressure by giving those who’ve served the support they need to live well after service.

Key takeaways

- The DVA Gold Card gives access to fully funded healthcare services, including GP visits, hospital care and mental health support.

- Cardholders may be eligible for extra discounts on utilities, rego, public transport and more through state and local concessions.

- Eligibility depends on service history, disability level or dependent status, with some civilians also included.

- Most services are billed directly to DVA, but some may need a GP referral or pre-approval.

- If you're not sure what you're entitled to, VetComp can help you understand your options and get started.

What is the DVA Gold Card?

The DVA Gold Card is a healthcare entitlement card provided by the Australian Department of Veterans’ Affairs (DVA). The card grants eligible veterans, dependents, and some civilians access to a wide range of fully funded healthcare services. It’s about recognising your service and helping you stay healthy and supported for the long run.

Who Does the DVA Gold Card Serve?

The Veteran Gold Card is issued to:

- Veterans who meet specific service or disability criteria.

- Dependents, including war widows/widowers and eligible children of deceased veterans.

- Certain civilians who participated in specific wartime operations.

📩 Believe you fit into one of these categories? Get in touch with us today, and we can start having a look at what benefits may be afforded to you.

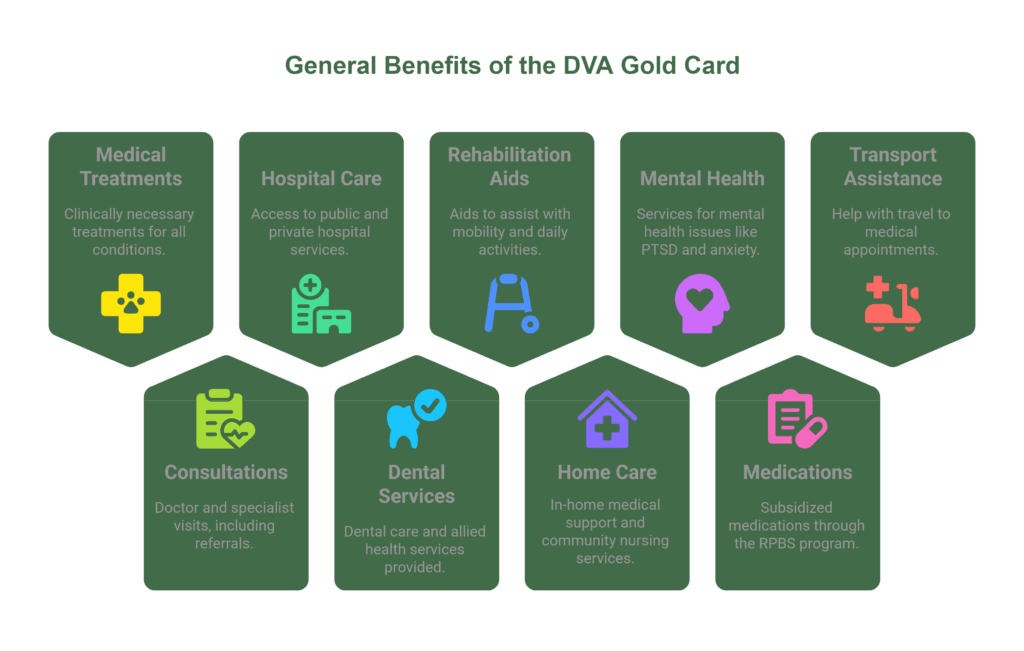

General Benefits of the DVA Gold Card

Holders of the DVA Gold Card receive access to:

- All clinically necessary medical treatments, whether related to military service or not, within Australia.

- Doctor and specialist consultations, including referrals when needed.

- Hospital care in both public and private facilities.

- Dental and allied health services, such as physiotherapy and podiatry.

- Rehabilitation aids and appliances to assist with mobility and daily living.

- Home care and community nursing for in-home medical support.

- Mental health services, including treatment for PTSD, anxiety, and depression.

- Subsidised medications through the Repatriation Pharmaceutical Benefits Scheme (RPBS).

- Transport assistance for travel to medical appointments.

While the Gold Card covers a wide range of medical services, some treatments may require prior approval, especially if they aren’t listed on the Medicare or Pharmaceutical Benefits Schedules.

At its core, the DVA Gold Card is a way for the government to support veterans and their families with ongoing care. It helps cover essential healthcare and extra services that can make everyday life more manageable for those who’ve served.

What Does the DVA Gold Card Cover?

The DVA Gold Card gives eligible veterans, their families, and some civilians access to fully funded healthcare and support. It covers a broad range of services including medical treatment, allied health, home care, mental health support, medications, and help with transport. Here’s a closer look at what’s included.

Medical and Healthcare Services

General Practitioner (GP) and Specialist Consultations

- Holders of the DVA Gold Card can visit GPs and medical specialists for consultations, medical assessments, and referrals without out-of-pocket expenses.

Hospital Care (Public and Private)

- The card covers hospital treatment in both public and private hospitals, ensuring access to necessary medical procedures and surgeries.

Dental and Allied Health Services

- Cardholders can access dental care, physiotherapy, chiropractic care, podiatry, and other allied health services to support rehabilitation and well-being.

Rehabilitation Aids and Appliances

- Veterans can receive mobility aids, prosthetics, and medical appliances to assist with their daily lives and improve their independence.

Home and Community Support

Home Care and Respite Care

- For those needing additional support at home, the card provides access to home care services, allowing veterans to receive medical attention and daily living assistance at home. Respite care is also available for caregivers needing temporary relief.

Community Nursing Services

- Nursing care can be provided in the home for eligible cardholders who require ongoing treatment, wound care, or health monitoring.

Mental Health Services

Coverage for PTSD, Anxiety, and Depression

- Mental health support is a key focus of the DVA Gold Card. It covers therapy, counselling, and psychiatric treatment for post-traumatic stress disorder (PTSD), anxiety, depression, and other mental health conditions.

Pharmaceutical Benefits

Access to Medications Under the Repatriation Pharmaceutical Benefits Scheme (RPBS)

- The RPBS ensures that DVA Gold Card holders receive subsidised or fully covered prescription medications, including those required for chronic and service-related conditions.

Transport Assistance

Support for Travel to Medical Appointment

- Veterans may be eligible for financial assistance or direct transport when travelling to and from medical appointments, ensuring they can access healthcare services without a financial burden.

Additional Considerations

Some Treatments Require Prior Approval from the DVA

While the DVA Gold Card covers most medically necessary treatments, some services, medications, or specialist procedures may need pre-approval, especially if they’re not listed under the Medicare Benefits Schedule (MBS) or Pharmaceutical Benefits Scheme (PBS).

If your compensation leads to a DVA Gold Card, we’re here to help with what comes next. From connecting you with the right support services to helping you find a GP who understands the DVA, we can guide you through the process.

Book a free consultation and let’s chat about how we can support you.

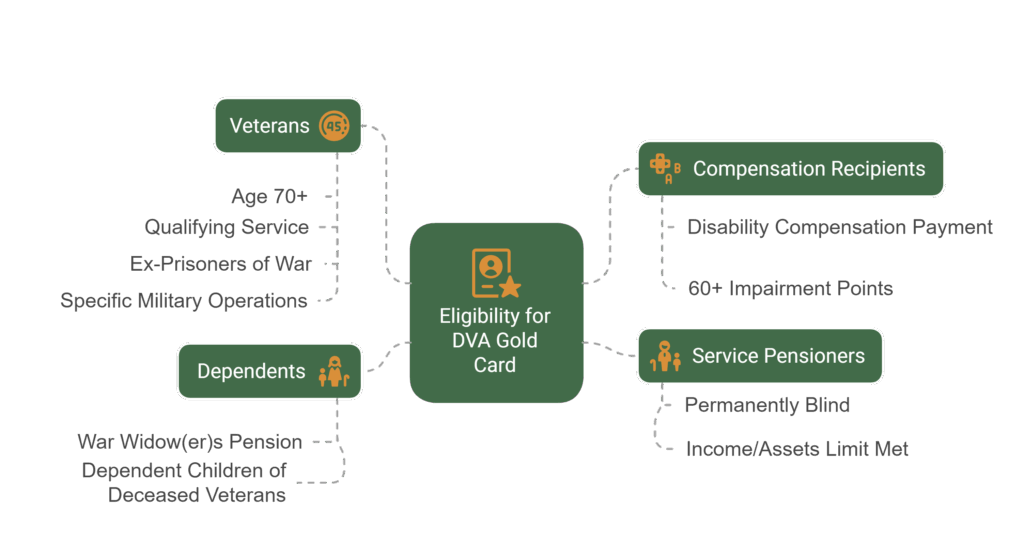

Who is Eligible for the DVA Gold Card?

The DVA Gold Card is granted based on specific eligibility criteria outlined in certain legislation, such as the Military Rehabilitation and Compensation Act 2004 (MRCA).

Veterans

- Veterans aged 70+ with qualifying service

- Ex-Prisoners of War

- Participants in Specific Military Operations: Veterans who took part in specific military operations may qualify, including members of the British Commonwealth Occupation Force in Japan after World War II, and those involved in the British Nuclear Test program in Australia.

Compensation Recipients

- Education or retraining

- Veterans with 60+ impairment points under MRCA

- Veterans who are permanently blind in both eyes

- Veterans meeting income/assets limits

Dependents

- War Widow(er)s receiving a War Widow(er)s Pension

- Dependent children of deceased veterans who meet specific criteria

Not sure if you’re eligible for a DVA Gold Card? Or know you should have one but haven’t received it yet?

Reach out to the team at VetComp and let us see how we can help you.

Additional Benefits Beyond Healthcare

While the DVA Gold Card primarily provides healthcare support, cardholders may also be entitled to state and local council concessions, ongoing benefits for their families, and additional financial assistance. These benefits extend beyond medical services, offering further support in everyday life.

State and Local Council Concessions

Many state and local governments offer discounts and rebates for DVA Gold Card holders, which may include:

- Utility bill concessions (electricity, gas, water).

- Public transport discounts or free travel options.

- Vehicle registration and driver’s license fee reductions.

- Council rate discounts on property taxes.

- Recreational and cultural benefits, such as entry discounts to museums, parks, and community centres.

Cardholders should check with their state government or local council to determine which concessions are available in their area.

Continued Benefits for Spouses and Dependents

If a DVA Gold Card holder passes away, their spouse or dependents may continue to receive certain benefits, including:

- Healthcare support for eligible dependents.

- Access to community care services to assist with daily living.

- Transport concessions and other entitlements at the state level.

How to Use the DVA Gold Card

To make the most of the DVA Gold Card, cardholders need to understand how to access medical services, billing processes, and referral requirements. Here’s what you need to know:

Presenting the Card at Medical Appointments

- Show the DVA Gold Card when visiting doctors, specialists, or healthcare providers to ensure direct billing to DVA.

- The card confirms eligibility for fully funded treatments and services.

Visiting DVA-Approved Healthcare Providers

Not all healthcare providers are DVA-approved, so cardholders should confirm whether their doctor, dentist, or specialist accepts Gold Card billing before booking an appointment. If the provider does not accept direct DVA billing, cardholders may need to pay upfront and request reimbursement.

Billing Process: Direct Billing to DVA

- Most medical, dental, and allied health services covered under the DVA Gold Card are billed directly to DVA.

- This means no out-of-pocket costs for cardholders (except in cases where a service is not covered and requires prior approval).

Referral and Pre-Approval Requirements

Some services require referrals or pre-approval from DVA, especially:

- Specialist consultations (GP referrals are typically required).

- Certain treatments or procedures are not listed under the Medicare Benefits Schedule (MBS) or Pharmaceutical Benefits Scheme (PBS).

- Assistance with Non-standard medications or alternative therapies.to work or transitioning careers

If in doubt, cardholders should consult their GP or contact the DVA to confirm coverage before undergoing treatment.

Making the Most of Your Gold Card

The DVA Gold Card is a lifeline for eligible veterans, dependents, and certain civilians, ensuring access to essential healthcare services, financial assistance, and additional benefits.

Veterans and their families deserve the best possible care and support for their service and sacrifices. If you or someone you know may be eligible for the DVA Gold Card, check with the Department of Veterans’ Affairs to ensure you’re making full use of the benefits available.

For more details, visit the DVA website or speak to one of our team members at VetComp, and we can assist you with your compensation and support needs.

FAQs

We’ve gathered our most commonly asked questions here, so you can feel informed, at ease, and ready to take the next step toward the support and benefits you deserve.

Who is eligible for the DVA Gold Card?

The DVA Gold Card is available to certain veterans, dependents, and compensation recipients under the Veterans’ Entitlements Act (VEA) and the Military Rehabilitation and Compensation Act (MRCA). Eligibility includes:

- Veterans aged 70+ with qualifying service.

- Ex-prisoners of war.

- Veterans with a 100% Disability Compensation Payment or 60+ impairment points under MRCA.

- War widows/widowers and eligible dependent children.

Does the DVA Gold Card cover all medical treatments?

Yes, the card covers all clinically necessary treatments, whether related to military service or not, as long as they are provided by a DVA-approved healthcare provider. However, some treatments may require prior approval, especially if they are not listed under the Medicare Benefits Schedule (MBS) or Pharmaceutical Benefits Scheme (PBS).

Can I use the DVA Gold Card outside of Australia?

No, the DVA Gold Card is only valid within Australia. If you require medical treatment overseas, you may need to check with DVA for alternative support options.

Does the DVA Gold Card cover my spouse and dependents?

The card is issued to individuals who qualify, but spouses and dependents do not automatically receive coverage. However, if a Gold Card holder passes away, their spouse or dependents may be eligible for continued benefits, including a War Widow(er)’s Pension and healthcare support.

How do I apply for a DVA Gold Card?

You can apply for a DVA Gold Card through DVA by:

- Visiting the DVA website and completing an online application.

- Calling the DVA support line for assistance.

- Speaking to an advocate at VetComp.

If you’re unsure about your eligibility, we can assist with this as well, even if there are additional claims to be put through to get you your DVA Gold Card.

What happens if my DVA Gold Card is lost or stolen?

If your DVA Gold Card is lost, stolen, or damaged, you should report it to DVA as soon as possible. You can request a replacement card by calling the DVA helpline or accessing your MyService account on the DVA website.

Are there any costs associated with using the DVA Gold Card?

For most standard medical treatments, doctor visits, and prescriptions, there are no out-of-pocket costs for DVA Gold Card holders. However, if you choose a non-DVA-approved provider or opt for extra services beyond standard coverage, you may have to pay a gap fee. Always check with your provider before receiving treatment.

Can I use my DVA Gold Card for private health insurance?

No, the DVA Gold Card is not a private health insurance policy. However, it does provide extensive coverage for medical services, hospital care, and allied health treatments. Some veterans may still choose to have private health insurance for services that are not covered by the DVA, such as elective treatments or international coverage.