For many veterans, the transition to civilian life comes with financial considerations, including support from the Department of Veterans’ Affairs (DVA). DVA payments are designed to provide financial assistance to eligible veterans, their families, and dependents, ensuring they receive adequate support based on their service and individual circumstances.

One of the most common questions among recipients is: Can I work while receiving DVA payments?

The answer is yes, but it depends on the type of payment. Some allow you to work with little impact, while others have limits around income or hours.

Understanding how work affects your payments can help you avoid issues, stay eligible and make confident choices. This guide breaks down what to expect, what to report and how to manage work alongside DVA support.

Key takeaways

- Working is allowed for most DVA payment recipients, but each payment type has different rules.

- The Income Test applies to many payments, meaning higher earnings may reduce pension amounts.

- The Work Bonus provides flexibility for pensioners to earn extra income without losing benefits.

- Veteran Payments has strict work limits—exceeding 8 hours per week may lead to ineligibility.

- Reporting changes in employment status is mandatory to avoid overpayments and ensure compliance.

- Seeking professional advice before returning to work can help veterans maximise benefits and plan their financial future.

Understanding DVA Payments and Work Eligibility

DVA provides several financial support options, each with its own set of rules regarding employment. Some payments are designed to support those unable to work due to service-related conditions, while others supplement income for veterans transitioning into or continuing employment.

Types of DVA Payments and Their Employment Rules

- Service Pension & Income Support Supplement: You can work while receiving these payments, but your earnings are subject to an income test, which may affect the amount you receive.

- Work Bonus: Designed to encourage older veterans to stay in the workforce, allowing them to earn a certain amount from employment without reducing their pension.

- Veteran Payment – If you receive this payment, you are limited to working up to 8 hours per week. Exceeding this threshold may make you ineligible.

- Incapacity Payments – You can work, but your payments may be adjusted based on your earnings. The payment rate is generally calculated as a percentage of your normal income, typically between 75% and 100%, depending on individual circumstances.

How Working Affects Eligibility

Not all employment will result in losing your DVA payments, but it’s important to know how earnings impact your entitlements:

- Income Tests Apply: Some payments are means-tested, meaning your income level may reduce the amount you receive.

- Work Limits Vary: Certain payments, like the Veteran Payment, have a strict work-hour cap, while others offer more flexibility.

- Payments May Be Adjusted: If you receive Incapacity Payments, your earnings will be assessed and payments adjusted accordingly.

Why Understanding the Rules Matters

Failing to comply with DVA’s income and employment regulations can lead to overpayments, repayment obligations, or even the loss of benefits. It’s essential to:

- Understand how your specific payment type is impacted by work

- Report any changes to your employment or income within the required timeframe

- Seek professional guidance if you’re unsure about how working may affect your financial support

By staying informed, veterans can make confident decisions about employment while ensuring their benefits remain secure.

Types of DVA Payments and Their Work Conditions

Not all DVA payments respond the same way when you return to work. It really comes down to the kind of payment you’re on. Some let you work with little to no impact, while others have rules around hours or income. Here’s a simple breakdown of the main payments and how work can affect each one.

Service Pension and Income Support Supplement

If you’re receiving a Service Pension or Income Support Supplement (ISS), you can still work. Just keep in mind that what you earn might affect how much you’re paid. These payments are income-tested, so any extra income from work could reduce the amount you get.

How Earnings Impact the Payment Amount

- The income test determines the level of pension payment reduction based on additional earnings.

- A set amount of income can be earned before payments start reducing. If earnings exceed this limit, the pension amount decreases progressively.

- If income rises beyond a certain threshold, eligibility for the pension may be lost.

- The Work Bonus (explained below) can help mitigate the impact of employment income.

It’s a good idea to keep an eye on the current DVA income thresholds so you know how much you can earn before your payments start to change.

Work Bonus

The Work Bonus helps older veterans stay in the workforce by letting them earn a bit more without it straight away affecting their DVA pension. It sets aside a portion of work income so it doesn’t count towards the income test.

How the Work Bonus is Applied

- Veterans of qualifying pension age can earn up to a specified amount without it being counted under the income test.

- The Work Bonus applies automatically—there’s no need to apply separately.

- Any unused Work Bonus amount can be carried forward, allowing flexibility for veterans with irregular work schedules.

- The Work Bonus only applies to employment income, meaning passive income (such as investments or rental income) is not covered.

This system provides a financial incentive for pensioners to remain in the workforce without an immediate reduction in support payments.

Veteran Payment

The Veteran Payment offers short-term support while a compensation claim is being assessed. Veterans can still work while receiving it, but there are clear limits on how many hours they can do.

Work Limitations

- Veterans can work up to 8 hours per week while receiving this payment.

- If a veteran is capable of working more than 8 hours per week, they may no longer qualify for the Veteran Payment.

- The work limitation ensures that the payment supports those who cannot engage in full employment due to service-related circumstances.

For veterans on this payment, careful monitoring of work hours is essential to avoid unintended ineligibility.

Incapacity Payments

Incapacity Payments are designed for veterans who are unable to work at their full capacity due to service-related injuries or conditions. These payments can be adjusted based on earnings, allowing veterans to work within their abilities while still receiving financial support.

Percentage-Based Adjustments

- Veterans can work while receiving Incapacity Payments, but their income from employment may reduce their payment amount.

- Payment adjustments are calculated based on a percentage of the veteran’s normal pre-injury earnings.

- Typically, Incapacity Payments are paid at a rate between 75% and 100% of normal earnings, depending on the individual’s circumstances.

- The exact reduction formula depends on the amount earned and the veteran’s assessed level of incapacity.

For veterans considering work while receiving Incapacity Payments, seeking financial advice can help ensure they understand how their earnings will impact their benefits. For more information about Incapacity Payments, visit our page about it here or reach out to our team here.

Reporting Requirements

No matter which DVA payment you receive, you’re legally required to report any changes to your work or income. This helps keep your payments accurate and within DVA rules.

When to Report Changes

To avoid overpayments or compliance issues, let DVA know about any changes to your earnings within:

- 14 days if you're a Service Pensioner or receive the Income Support Supplement

- 28 days if you're overseas or receive a remote area allowance

- 14 days if you’re a Social Security Age Pensioner paid by DVA (28 days if living overseas)

Delays in reporting can result in overpayments, potential penalties, or a loss of benefits. It’s best to report changes as soon as possible to keep everything on track.

Impact of Working on DVA Payments

Working while receiving DVA payments can affect how much support you receive. Your payments may stay the same, be reduced, or paused depending on your income, the type of payment, and programs like the Work Bonus. Below are the main things to keep in mind when it comes to how employment may impact your DVA support.

Income Test Considerations

DVA applies an income test to certain payments, meaning that any earnings from employment could lead to a reduction in the amount received.

How the Income Test Works

- Each payment type has income thresholds—limits on how much you can earn before your payments begin to reduce.

- Earnings below the threshold will generally have no impact.

- If income exceeds the threshold, your payments may be gradually reduced according to a taper rate (the rate at which payments decrease per dollar earned).

- Exceeding a maximum limit may result in losing eligibility for the payment altogether.

Since these thresholds can change due to policy updates, it’s important to check current income limits on the DVA website or speak with an advocate at VetComp to understand your specific situation.

Work Bonus Application

For eligible veterans, the Work Bonus can help offset the impact of employment income on pension payments by exempting a portion of earnings from the income test.

How the Work Bonus Helps

- The Work Bonus allows pensioners to earn a certain amount without it affecting their pension.

- If a veteran does not use their full Work Bonus in one pay period, unused amounts can be accrued and applied to future earnings.

- It is automatically applied to eligible veterans receiving certain DVA payments.

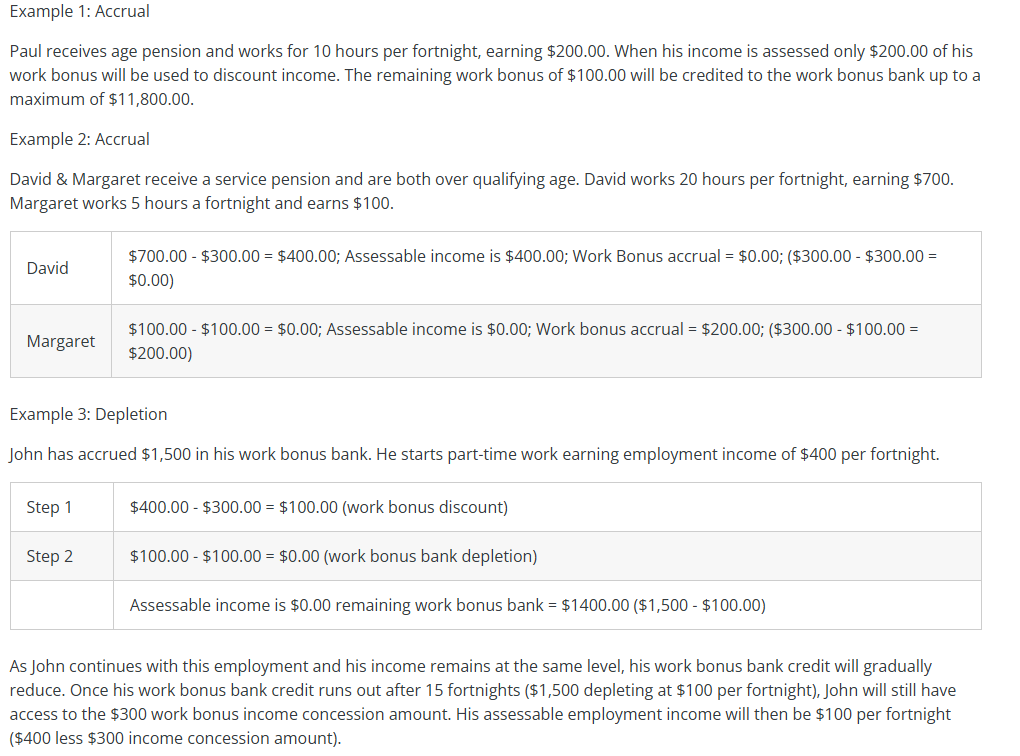

Above is taken from the DVA website here, which shows three examples of the technicalities of the work bonus.

Averaging of Earnings for Irregular Work

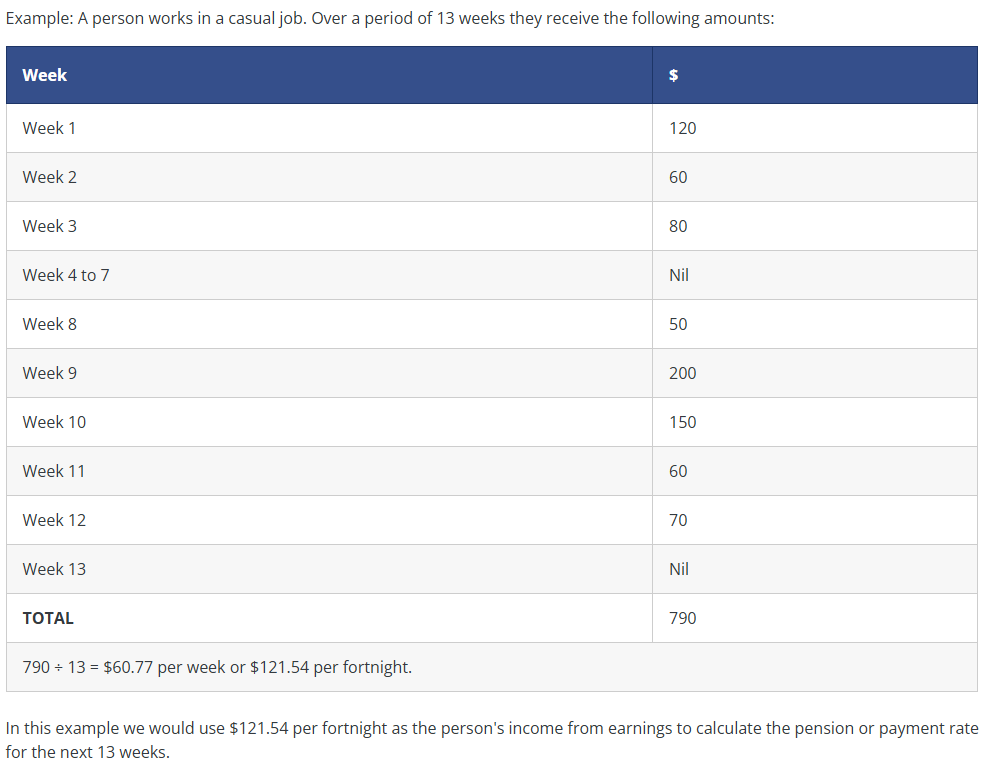

Many veterans take on seasonal, contract, or casual work, which results in fluctuating income. Instead of assessing payments based on one-time spikes in income, DVA may apply an earnings averaging system.

How Averaging Works

- Earnings from seasonal or intermittent employment may be averaged over a longer period to prevent drastic fluctuations in DVA payments.

- This helps prevent temporary loss of benefits due to short-term high earnings.

- The specific calculation method varies depending on the type of payment and employment arrangement.

The above example is taken from DVA here, demonstrating how fortnightly payments are worked out when income varies from week to week. Averaging helps provide more stability for veterans with irregular work patterns, so a short-term spike in earnings doesn’t lead to an immediate drop in support.

Seeking Professional Guidance Before Returning to Work

Before heading back to work, it’s worth taking the time to think about how it might affect your payments, health and day-to-day life. Talking to someone who understands the DVA system can help you make informed choices and avoid any unexpected setbacks.

Importance of Financial Advice

DVA payments and employment income rules can be complex, making it essential to seek professional financial advice. A financial adviser can help:

- Understand how earnings will impact income-tested payments.

- Strategise work schedules and income levels to maximise benefits.

- Plan for tax implications related to additional earnings.

Some financial advice services may be available through DVA programs or veteran-focused organisations. At VetComp, we work closely with advisers who understand the DVA system and are happy to connect you with someone who can help.

Engaging with DVA Rehabilitation Providers

For veterans who have been out of the workforce for an extended period or have service-related injuries, returning to work may require additional support and rehabilitation. DVA provides rehabilitation programs that offer:

- Workplace support and modifications for veterans with physical or psychological conditions.

- Career guidance and retraining for veterans transitioning into new roles.

- Health and well-being support to ensure a smooth reintegration into employment.

Veterans who need assistance with career planning or workplace adjustments should consider engaging with a DVA rehabilitation provider before returning to work.

Notifying DVA Before Starting Work

To prevent overpayments or payment suspensions, veterans should notify DVA before starting work. This allows DVA to:

- Assess how employment will impact benefits and provide guidance on reporting obligations.

- Ensure veterans are taking advantage of available support programs.

- Prevent potential financial disruptions caused by unreported earnings.

Letting DVA know about work plans early can help avoid payment issues and keep your support steady while you ease back into employment.

Keeping Your Support Steady as Life Changes

If you’re receiving DVA payments and thinking about returning to work, it’s worth taking the time to understand how your earnings might affect your support. Every payment type has its own rules, and staying across things like income limits and reporting can make a big difference.

You don’t have to figure it all out on your own. If you’re feeling unsure or just want someone to talk it through with, the team at VetComp is here to help. We’ll walk you through your options and help take the pressure off.

📩 Get in touch with one of our experienced DVA Advocates today.

FAQs

We’ve gathered our most commonly asked questions here, so you can feel informed, at ease, and ready to take the next step toward the support and benefits you deserve.

Can I work while receiving DVA payments?

Yes, you can work while receiving DVA payments, but the impact on your benefits depends on the type of payment you receive. Some payments have income tests, while others have strict work limitations.

How much can I earn before my DVA payments are reduced?

The amount you can earn before your payments are reduced depends on income thresholds and the type of payment. The Service Pension and Income Support Supplement are income-tested, meaning your pension may be reduced if your earnings exceed a certain limit. The Work Bonus may also allow you to earn more without affecting your pension.

What is the Work Bonus, and how does it help?

The Work Bonus is an initiative that allows pensioners to earn a set amount from employment without it being counted under the income test. If you don’t use your full Work Bonus in one period, the unused amount can be carried forward for future earnings.

Can I work while receiving a Veteran Payment?

Yes, but only up to 8 hours per week. If you work more than this, you may no longer be eligible for the Veteran Payment.

What happens if I don’t report my earnings to DVA?

Failing to report income changes within the required timeframe can result in overpayments, which you may need to repay. It could also lead to penalties or loss of benefits, so it’s important to update DVA as soon as your employment situation changes.

Can I do seasonal or contract work while on DVA payments?

Yes, but if your income fluctuates, DVA may apply earnings averaging to assess how your payments are impacted over time. This prevents temporary spikes in income from immediately affecting your benefits.

Will working impact my Incapacity Payments?

Yes. Incapacity Payments are based on a percentage of your pre-injury earnings, and if you work, your payment amount may be adjusted. The reduction depends on how much you earn and your assessed incapacity level.

How can I make sure I remain eligible for my DVA payments while working?

To stay eligible, you should:

- Understand the work rules for your specific DVA payment type.

- Keep track of your earnings to ensure they don’t exceed allowable thresholds.

- Report any changes in work status or income to DVA within the required timeframe.

- Seek advice from a VetComp advocate if unsure about how employment affects your payments.