DVA Lump Sum Compensation, How Much Are You Entitled To?

Many veterans know the DVA provides financial support for service-related injuries, but few realise their full entitlements. Compensation is governed by multiple laws, including the Veterans’ Entitlements Act 1986 (VEA) and the Safety, Rehabilitation and Compensation (Defence-related Claims) Act 1988 (DRCA). This article focuses on the Military Rehabilitation and Compensation Act 2004 (MRCA), which covers those who served from 1 July 2004.

Lump sum compensation recognises service-related conditions and offers financial support. But how much can you receive?

What is the maximum lump sum for DVA compensation?

For eligible veterans under the Military Rehabilitation and Compensation Act (MRCA), lump sum compensation can reach up to $550,000+—and it’s completely tax-free.

This financial support helps veterans adapt to life with a service-related impairment and ensures they have the resources needed for their future.

The exact amount a veteran may receive depends on:

- The degree of impairment (DVA Impairment Tables).

- Whether the veteran chooses a lump sum or periodic weekly payments.

- Additional compensation available for dependents

💡 If you have children or financial dependants, you may also be entitled to an additional lump sum of over $108,000 per eligible child. This benefit, known as the Severe Impairment Payment (SIP), is designed to provide extra support for veterans who have been assessed at 80 impairment points or more.

👉 Learn more about the Severe Impairment Payment (SIP) here

Want an Estimate? Use Our DVA Payout Calculator

Many veterans aren’t sure what they may be entitled to. Get a quick estimation using VetComp’s Maximum DVA Lump Sum Calculator: Check Your Potential Payout Here.

Understanding Lump Sum Compensation

DVA provides various forms of compensation, but one of the most significant is the lump sum for permanent impairment. This payment is designed to acknowledge the long-term impact of a service-related condition and provide financial support to help veterans adjust.

The amount a veteran receives isn’t one-size-fits-all—it depends on:

- Impairment rating (higher impairment = higher payout).

- Service history (peacetime vs. operational service can affect compensation).

- Age at the time of claim (affects compensation calculations).

For more details, refer to DVA’s Compensation and Support Policy Library.

Reviewed and Increased Each Year

DVA reviews compensation rates annually to keep up with the cost of living. Many payments, including permanent impairment compensation, are adjusted regularly to ensure they continue to provide meaningful support (DVA Compensation Rates).

Tax-Free Compensation

Unlike other types of financial assistance, DVA lump sum payments for permanent impairment are tax-free, meaning veterans receive the full amount without deductions (ATO Government Payments and Allowances).

While figures change due to government indexation, one thing is clear: this compensation is designed to provide long-term financial stability and recognition of a veteran’s service-related impairment.

Why the Timing of Your Claim Matters

Many veterans delay lodging their DVA claims, assuming they can always apply later.

While it is true that you can lodge your claim at any time, many ADF veterans don’t realise that submitting a DVA claim sooner could lead to a higher compensation factor. DVA applies an age conversion factor when calculating lump sum payments:

✅ Younger veterans receive higher payments because they have more years ahead to manage their impairment.

❌ Older veterans receive lower payments because the formula adjusts based on age.

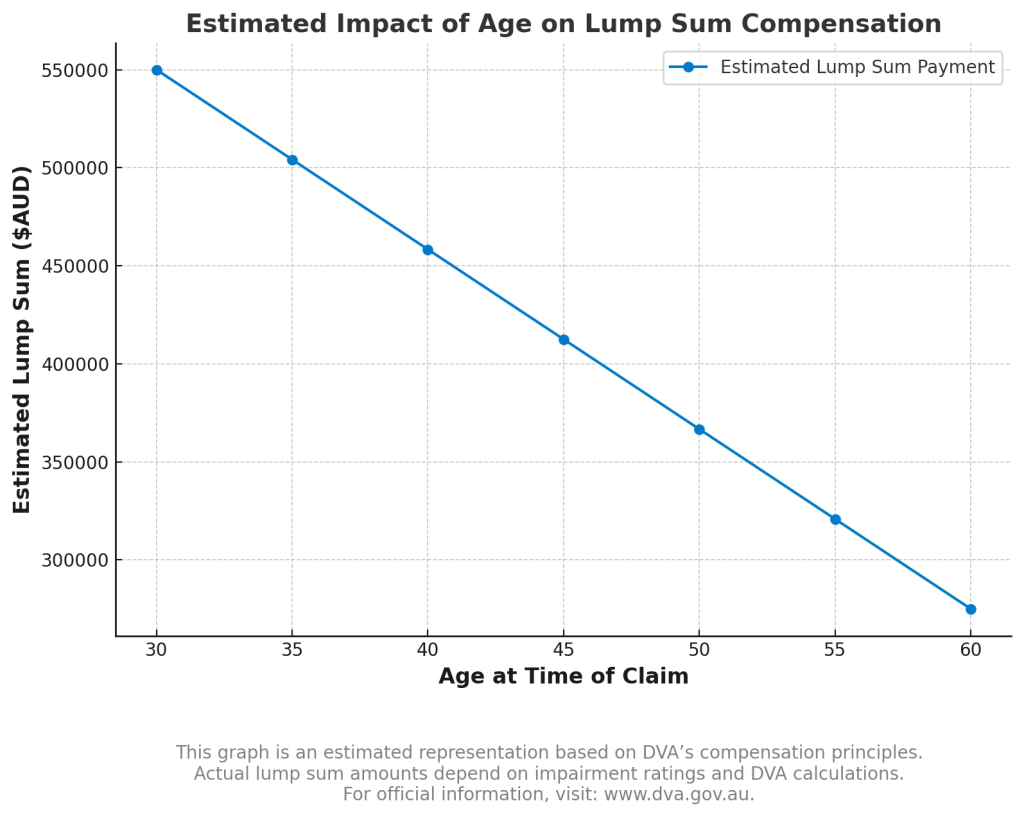

Graph: Estimated Impact of Age on Lump Sum Compensation

This graph provides a visual estimate of how DVA’s age conversion factor may affect lump sum compensation amounts.

⚠ Disclaimer: This is an estimated representation based on DVA’s compensation principles. Actual lump sum amounts depend on impairment ratings and official DVA calculations. For official details, visit: www.dva.gov.au.

Example

- A 30-year-old veteran with a certain impairment rating may receive significantly more than a 50-year-old veteran with the same rating.

- The longer a veteran delays submitting their claim, the more the age factor reduces the lump sum amount (DVA Age Factors Table).

This financial support is designed to assist veterans in adapting to life with a service-related condition. Submitting a claim at the right time ensures they receive the level of support they need.

The Importance of a Comprehensive Claim Submission

DVA claims involve detailed medical assessments, eligibility criteria, and legislative considerations. Many veterans don’t receive the full support available to them simply because they aren’t aware of how claims are assessed or what evidence is required.

This is where expert guidance can make a real difference.

VetComp is run by veterans, for veterans—we understand both the system and the unique challenges veterans face. Our focus is on:

- Ensuring veterans receive the financial support they’re entitled to.

- Submitting claims correctly so that no important details are overlooked.

- Connecting veterans with experts who understand their unique needs.

- Providing ongoing support after a successful claim

A well-prepared claim ensures that veterans receive the full recognition and assistance they deserve.

For more details, visit DVA’s Compensation Overview.

Conclusion

Lump sum compensation is designed to support veterans as they navigate life with a service-related condition. However, many veterans don’t realise what they may be entitled to, or how the timing and structure of their claim can impact their payout.

Key Takeaways

- DVA MRCA lump sum compensation can be substantial—up to $550,000+ and tax-free.

- DVA lump sum Payments are reviewed and often increased each year.

- The timing of your claim can affect your compensation, so applying sooner may be beneficial.

- Using our estimator is a simple way to get a rough idea of what you may receive.

- Having an expert in your corner can ensure your claim is submitted with care.

🔹 Check Your Potential DVA Payout Now: VetComp’s Lump Sum Calculator